If a Payment Through Messenger Bounces Will.it Be Sent Through Again

When you lot chat with friends about settling debts or splitting the nib, Facebook doesn't want you to take to open another app like PayPal or Venmo to transport them coin. So today it unveiled a new payments feature for Facebook Messenger that lets y'all connect your Visa or Mastercard debit card and tap a "$" button to send friends money on iOS, Android, and desktop with cipher fees. Facebook Messenger payments will roll out kickoff in the U.S. over the coming months.

Facebook And PayPal: Frenemies?

Rather than lean on a payments company like PayPal to power the characteristic, Facebook built information technology from the basis upwards from its feel processing over ane 1000000 payments a day through its ads and games platforms. Transactions and payment info are encrypted, and Facebook says "These payment systems are kept in a secured environment that is split from other parts of the Facebook network and that receive additional monitoring and control," from an anti-fraud team.

By making payments part of its ofttimes-used messaging service rather than a standalone app, Facebook is looking to edge out dedicated P2P payment competitors like Venmo/PayPal, Google Wallet, and Foursquare Cash, which people open less frequently. That's the same strategy as the Square Cash-powered Snapcash characteristic Snapchat launched in November.

By making payments part of its ofttimes-used messaging service rather than a standalone app, Facebook is looking to edge out dedicated P2P payment competitors like Venmo/PayPal, Google Wallet, and Foursquare Cash, which people open less frequently. That's the same strategy as the Square Cash-powered Snapcash characteristic Snapchat launched in November.

PayPal gave a argument (emphasis mine) saying:

We have had a great relationship with Facebook since 2008 and currently work closely together to evangelize like shooting fish in a barrel payments on a global scale for its games and ads businesses.

PayPal has always taken a partnership approach to payments and we volition proceed to piece of work with Facebook and many other companies on new payments experiences that make it easier for people to send and receive money on both the PayPal and Braintree platforms.

When I asked a PayPal spokesperson if the visitor views Facebook Messenger payments every bit a "competitor," they advisedly avoided that word but eventually admitted "it does have like technology and does a similar thing to what Venmo does."While Venmo makes transfers with virtually debit cards free, Facebook'due south free service will undercut PayPal's 2.9 percent plus $0.30 fee per transaction from debit cards.

"Nosotros're not building a payments business concern here," Facebook'due south product manager on the characteristic Steve Davis tells me. Instead, Davis says the goal is to offer P2P payments for costless to make Messenger "more than useful, expressive and delightful." Since Facebook makes so much money on ads, $3.59 billion in Q4, information technology doesn't take to monetize payments direct. Facebook just needs to keep people locked into its platform and seeing News Feed ads by making Messenger as helpful every bit possible.

Payments In Messenger

TechCrunch was the first to study Facebook was building peer-to-peer payments into Messenger back in October when we attained hacked screenshots dug out of Messenger's code by developer Andrew Aude. Since then, I've heard from several sources that Facebook was doing intense internal testing of the feature.

In the meantime, Facebook worked with PayPal, Braintree and Stripe to ability auto-fill up of billing details for e-commerce checkouts, and built a Purchase button for making purchases from the News Feed.

Davis says the product evolved from a unlike initial incarnation but was cagey about exactly how long Facebook has been working on the feature. He did note that it was well in the works when the company poached PayPal president David Marcus to run its Messenger partition.

"We wanted to examination this and make sure we had actually hitting a loftier bar because money is extremely important." Now its payments in Messenger is set for a gradual public rollout stateside. Here'due south how it works.

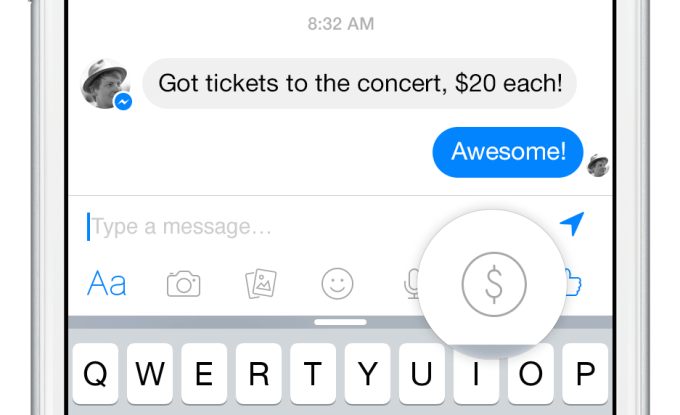

Once users become the feature, they'll see a "$" button in the Messenger message composer next to the options to send a photo or sticker. When they tap it, Facebook will inquire them to enter their debit carte info. Users won't have to fiddle with finding and entering banking concern business relationship and routing info, making it easier than some alternatives, but they can only use Visa and Mastercard debit cards. Facebook decided against allowing credit cards considering they would entail fees and information technology didn't desire users to get charged if they didn't understand.

For extra security, users are prompted to set an in-app payments passcode or Apple tree TouchID fingerprint to ostend transfers, though they tin opt out of this extra authentication in the settings. If users already accept a debit carte on file with Facebook from gaming, ads or donations, they tin can use that, too.

For extra security, users are prompted to set an in-app payments passcode or Apple tree TouchID fingerprint to ostend transfers, though they tin opt out of this extra authentication in the settings. If users already accept a debit carte on file with Facebook from gaming, ads or donations, they tin can use that, too.

One time the $ button is tapped, users enter the dollar amount and hit Pay. The money is instantly taken from their debit account and delivered to the recipient's debit account. Facebook never holds the money, though the receiver's bank will usually take a few days to brand the funds available as is standard. Both users see a confirmation message detailing the transfer condition and fourth dimension.

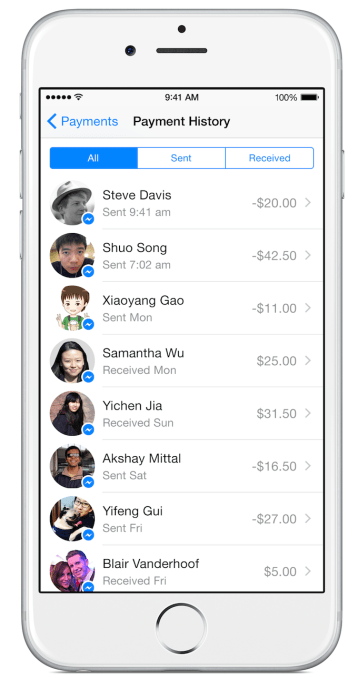

In case anything looks fishy, Facebook will ask users some extra financial security questions before a transfer goes through. Afterwards, users tin come across all their previous payments and funds received in the Payments History department of Messenger's settings.

"It'south manifestly non a feature you're going to use 10 times a day," say Davis. "Only when you lot do need to send money, this is probably going to be the best fashion to exercise it."

Convenience Is King

Davis explains that "conversations most money are already happening on Messenger," as people chat about bar tabs, splitting dinner bills, and sharing the price of an Uber. "What nosotros desire to practise is make it easy to finish the conversation in the aforementioned identify you started. You don't have to switch to another app," Davis tells me.

At present the question is whether this is the first step towards Messenger becoming a more full-featured experience. Messenger could follow the trend of monolithic chat apps of Asia like WeChat that permit you brand payments, eastward-commerce purchases, hail taxis and more. Messenger is going to take announcements at next week's f8 programmer conference, and nosotros could run across more platform ambitions from information technology then.

While only in the U.S. for now, if Facebook opened up Messenger payments internationally, it could help migrant workers send money home much cheaper than through loftier-fee remittance services. Just for now, Facebook says it only wants to get friend-to-friend payments right in the States. "Nosotros'll consider where to accept information technology after that one time nosotros become everything nailed down," says Davis.

When people's money is at stake, there'south no room for bugs.

brightfaverectoor.blogspot.com

Source: https://techcrunch.com/2015/03/17/facebook-pay/

0 Response to "If a Payment Through Messenger Bounces Will.it Be Sent Through Again"

Mag-post ng isang Komento